Navigating the world of investments can feel like charting uncharted waters. However, understanding the power of diversification with global equity funds offers a compelling strategy to potentially mitigate risk and enhance long-term growth. This exploration delves into the intricacies of global equity funds, examining their various types, risk profiles, and the crucial role they play in building a robust investment portfolio.

From understanding the nuances of different fund categories – like large-cap, mid-cap, and small-cap – to grasping the significance of geographic and sector diversification, we’ll equip you with the knowledge to make informed decisions. We will also analyze the impact of various factors, such as currency fluctuations and political instability, on your investment strategy, ultimately guiding you towards building a portfolio aligned with your risk tolerance and financial objectives.

Selecting Appropriate Global Equity Funds

Choosing the right global equity fund is crucial for building a diversified investment portfolio aligned with your financial goals and risk tolerance. Understanding your individual circumstances and carefully evaluating fund characteristics are key steps in this process. This section will guide you through the process of selecting a fund that suits your needs.

Factors to Consider When Choosing a Global Equity Fund

Several key factors influence the suitability of a global equity fund for an individual investor. These factors should be carefully weighed against your personal financial situation and investment objectives. Failing to consider these aspects could lead to suboptimal investment outcomes.Expense ratios and management fees directly impact your investment returns. Lower fees generally translate to higher net returns over time.

For example, a fund with a 1% expense ratio will cost you $100 per year for every $10,000 invested, while a fund with a 0.5% expense ratio will cost only $50. This seemingly small difference can compound significantly over the long term. Past performance is another important factor, although it’s not a guarantee of future results. Analyzing a fund’s historical performance against its benchmark index provides valuable insights into its investment strategy and risk profile.

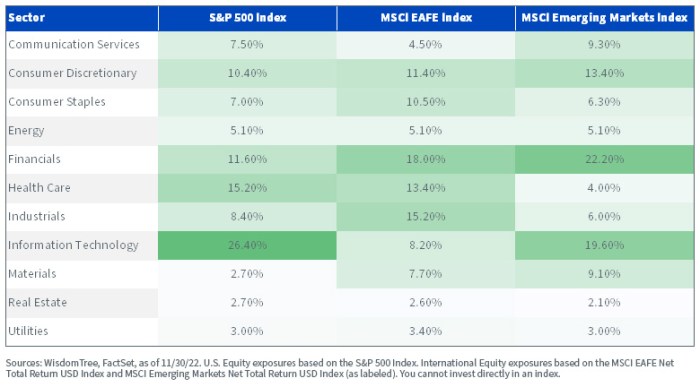

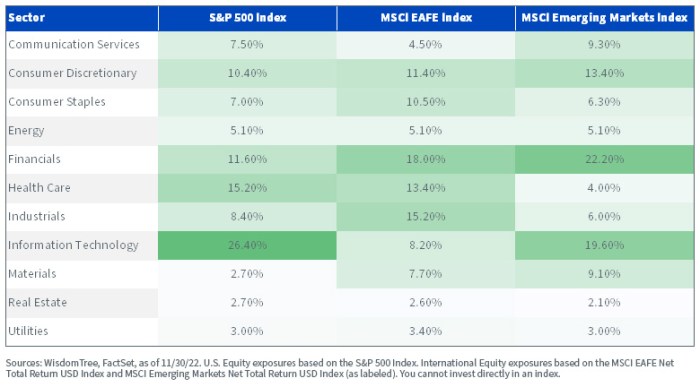

However, it’s essential to remember that past performance is not necessarily indicative of future returns. Furthermore, the fund’s investment strategy, including its geographic diversification and sector allocation, should align with your risk tolerance and investment goals. A conservative investor might prefer a fund with a lower risk profile and a focus on established companies, while a more aggressive investor might opt for a fund with higher growth potential, even if it carries greater risk.

Essential Criteria Checklist for Evaluating Global Equity Funds

This checklist provides a structured approach to comparing different global equity funds. Using this framework will help ensure a thorough evaluation before making an investment decision.

| Criterion | Description | Rating (1-5, 5 being best) | Notes |

|---|---|---|---|

| Expense Ratio | Annual cost of managing the fund, expressed as a percentage of assets. | Aim for expense ratios below 1%. | |

| Management Fees | Separate fees charged for fund management services. | Consider the overall cost, including expense ratios and management fees. | |

| Past Performance (5-year & 10-year) | Historical returns of the fund, compared to its benchmark index. | Analyze trends and consistency of returns. Remember past performance is not indicative of future results. | |

| Investment Strategy | The fund’s approach to investing (e.g., growth, value, income). | Ensure alignment with your investment goals and risk tolerance. | |

| Geographic Diversification | The fund’s allocation of assets across different countries and regions. | Higher diversification generally reduces risk. | |

| Sector Allocation | The fund’s exposure to different industry sectors. | Evaluate sector concentration and its potential impact on risk. | |

| Fund Size | Total assets under management (AUM). | Very large funds may have liquidity advantages, but very small funds may have higher risk. | |

| Minimum Investment | The minimum amount required to invest in the fund. | Ensure it aligns with your investment capacity. | |

| Risk Tolerance | The fund’s volatility and potential for losses. | Select a risk level that aligns with your comfort level. | |

| Fund Manager Experience | The experience and track record of the fund manager. | Research the manager’s investment philosophy and success. |

Illustrative Example

This section presents a hypothetical example illustrating the performance of a diversified global equity fund over a 10-year period. It highlights the typical fluctuations inherent in global markets and the potential for both significant gains and losses. The example is for illustrative purposes only and does not represent the performance of any specific fund.This hypothetical fund, let’s call it the “Global Growth Fund,” invests in a diversified portfolio of large-cap and mid-cap equities across developed and emerging markets.

The fund aims for long-term growth by capitalizing on global economic trends and diversification across various sectors.

Annual Returns and Volatility

The Global Growth Fund experienced varied annual returns over the ten-year period. The first three years saw relatively strong performance, with annual returns averaging 12%. However, year four witnessed a global market correction, resulting in a -5% return. Years five and six saw moderate recovery, with returns of 8% and 7%, respectively. Years seven and eight saw a surge in emerging markets, leading to returns of 15% and 13%.

The final two years experienced more moderate growth at 6% and 5%. The overall average annual return over the decade was approximately 8%. The volatility, measured by the standard deviation of annual returns, was approximately 7%, reflecting the inherent risk associated with global equity investments.

Drawdown

The Global Growth Fund experienced a maximum drawdown of approximately 15% during the market correction in year four. This drawdown represents the peak-to-trough decline in the fund’s value during that period. The recovery from this drawdown took approximately two years, highlighting the importance of a long-term investment horizon when dealing with market fluctuations. While drawdowns are an inevitable part of equity investing, a well-diversified portfolio can help mitigate their severity and duration.

Performance in Different Market Conditions

The Global Growth Fund’s performance demonstrated its ability to navigate various market conditions. During periods of strong global economic growth, the fund benefited from broad-based gains across its holdings. Conversely, during periods of market uncertainty, such as the correction in year four, the fund’s diversification helped to limit losses. The fund’s exposure to emerging markets in years seven and eight contributed significantly to its outperformance during that period, showcasing the potential benefits of geographic diversification.

The more moderate returns in the final two years reflect a period of slower economic growth globally. This example underscores the importance of considering both the upside potential and the inherent risks associated with global equity investments.

In conclusion, global equity funds present a powerful tool for investors seeking diversification and potentially enhanced returns. By carefully considering factors such as fund type, geographic exposure, sector allocation, and risk tolerance, investors can construct a portfolio that aligns with their individual financial goals. Understanding the inherent risks and potential rewards associated with global equity funds is paramount to making sound investment decisions and achieving long-term financial success.

Remember that professional financial advice is always recommended before making any investment decisions.

Essential Questionnaire

What is the minimum investment amount for global equity funds?

Minimum investment amounts vary significantly depending on the fund and the brokerage platform. Some funds may have low minimums, while others may require substantially larger initial investments. Check with the fund provider or your broker for specifics.

How often are global equity fund prices updated?

Global equity fund prices are typically updated daily, reflecting the closing prices of the underlying assets. However, the exact timing might vary slightly depending on the market and the fund manager.

Are global equity funds suitable for all investors?

No, global equity funds carry inherent risks, including market volatility and currency fluctuations. They are generally more suitable for investors with a longer-term investment horizon and a higher risk tolerance. Investors with shorter time horizons or lower risk tolerance might consider other investment options.

What are the tax implications of investing in global equity funds?

Tax implications vary based on your jurisdiction and the specific fund structure. Capital gains taxes may apply to any profits generated from the fund. Consult a tax professional for personalized advice.