Navigating the world of investments can feel like traversing a dense forest, especially when faced with choices like equity funds and index funds. Both offer pathways to wealth creation, but their approaches differ significantly. Understanding these differences is crucial for aligning your investment strategy with your financial goals and risk tolerance. This guide provides a clear comparison, illuminating the key distinctions between these two popular investment vehicles.

We will delve into the core investment strategies, exploring the active management style of equity funds and the passive approach of index funds. A detailed examination of risk profiles, potential returns, and expense ratios will follow, allowing for a comprehensive understanding of the nuances involved. Finally, we will offer guidance on selecting the fund type most suitable for your individual circumstances, empowering you to make informed investment decisions.

Introduction to Equity Funds and Index Funds

Equity and index funds are two popular investment vehicles offering distinct approaches to wealth building. Understanding their core differences is crucial for investors seeking to align their investment strategies with their risk tolerance and financial goals. This section provides a clear overview of each fund type and highlights their key differentiating characteristics.

Equity funds are investment pools that primarily invest in the stocks (equities) of various companies. These funds are actively managed by professional fund managers who aim to outperform a benchmark index by carefully selecting stocks they believe will generate higher returns.

Index funds, conversely, are passively managed investment vehicles designed to mirror the performance of a specific market index, such as the S&P 500 or the Nasdaq Composite. Rather than attempting to beat the market, index funds aim to match its returns by holding a portfolio of stocks that closely reflects the composition of the chosen index. This strategy minimizes the need for active management and generally results in lower expense ratios.

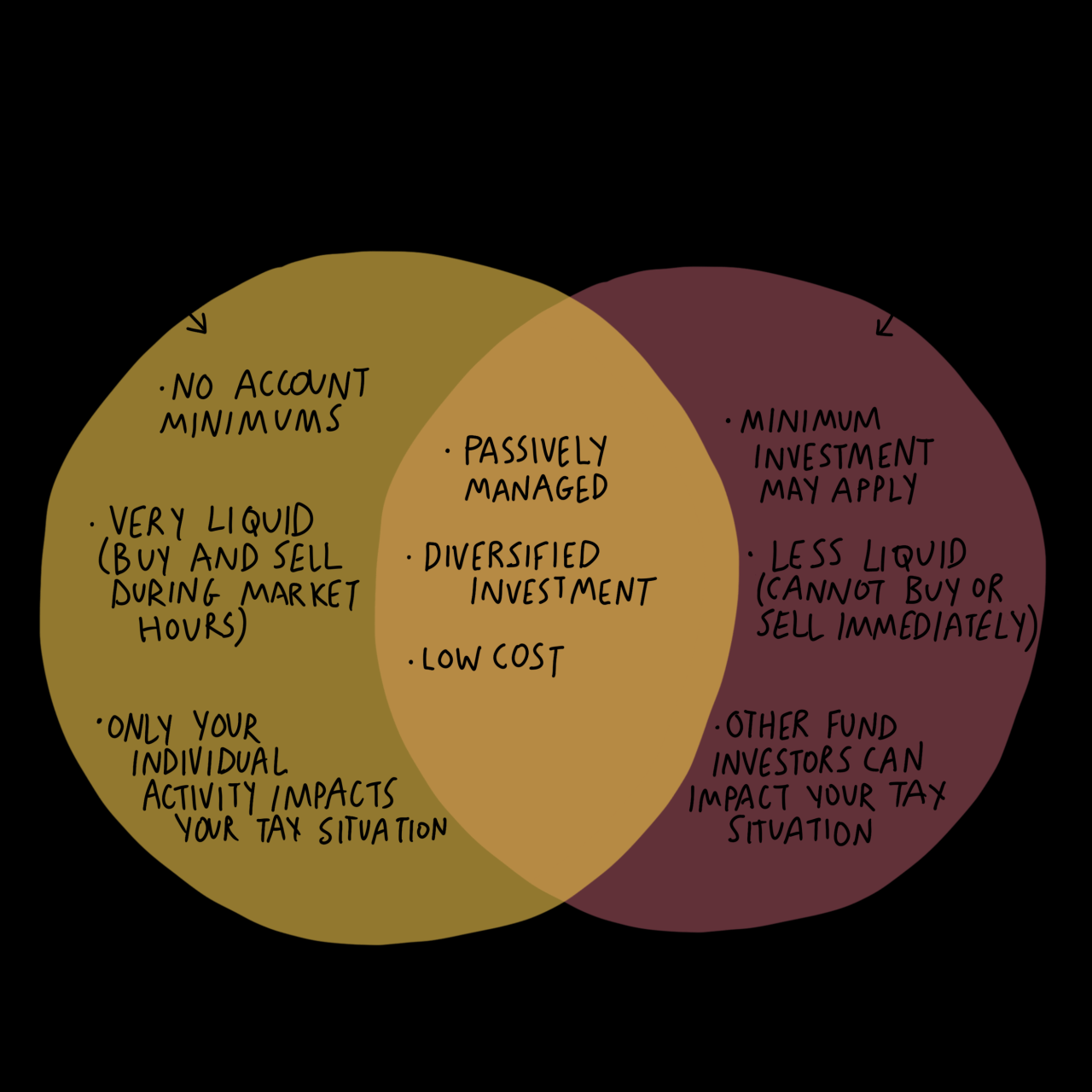

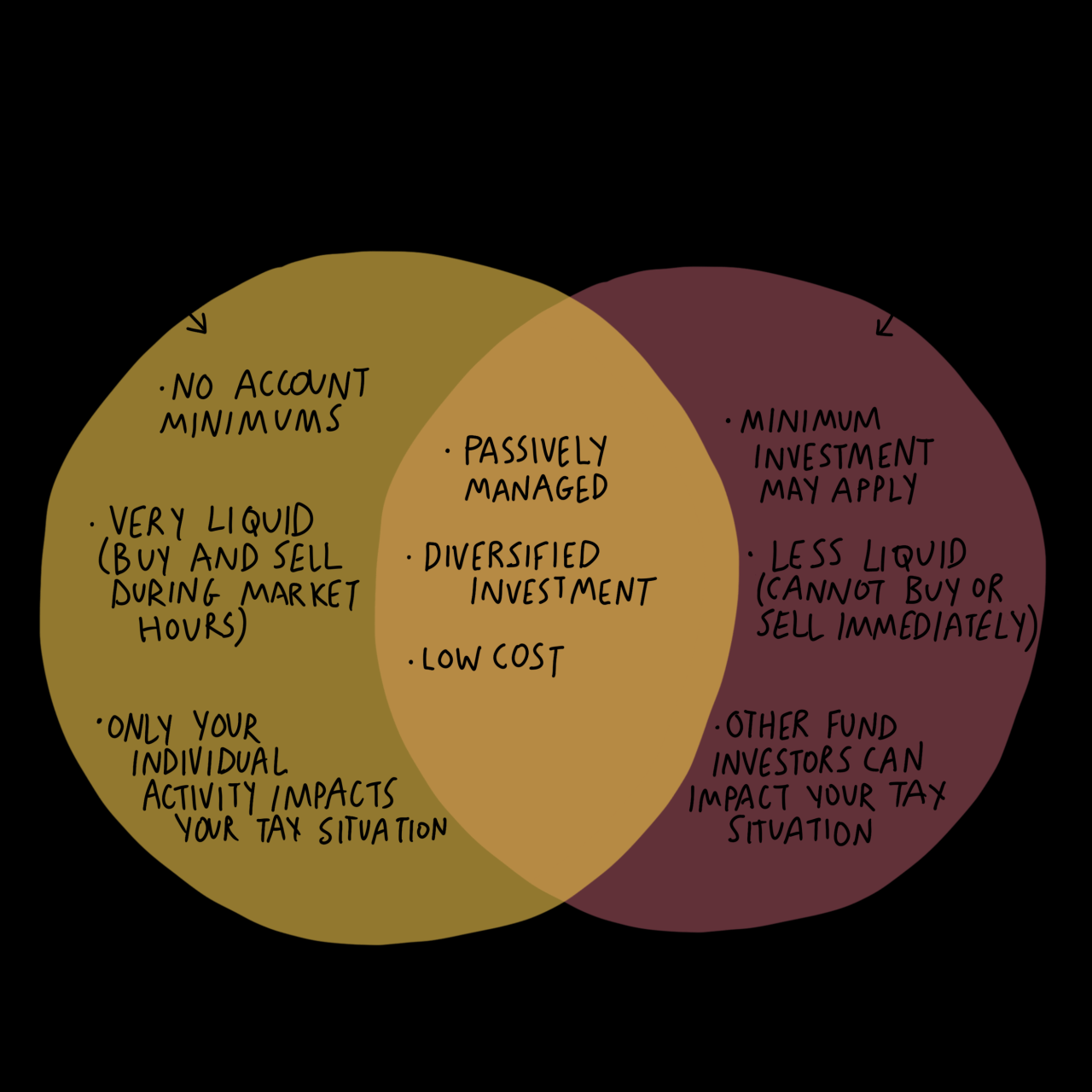

The core difference lies in their investment strategies. Equity funds employ active management, aiming to achieve higher returns than the market benchmark through stock picking and market timing. Index funds, on the other hand, adopt a passive management strategy, replicating the composition of a specific market index and aiming to match its performance.

Key Features Comparison

The following table summarizes the key differences between equity funds and index funds:

| Fund Type | Investment Strategy | Expense Ratio | Risk Level | Potential Return |

|---|---|---|---|---|

| Equity Fund | Actively managed; aims to outperform the market | Generally higher | Potentially higher; depends on fund’s investment strategy | Potentially higher; but not guaranteed to outperform the market |

| Index Fund | Passively managed; aims to match the performance of a specific index | Generally lower | Generally lower; mirrors market volatility | Generally matches the market return; lower potential for outsized gains |

Investment Strategies and Management

Equity funds and index funds diverge significantly in their investment approaches and the roles of their fund managers. Understanding these differences is crucial for investors seeking to align their investment goals with the appropriate fund type. This section will detail the contrasting strategies and management styles of actively managed equity funds and passively managed index funds.

Active Management in Equity Funds

Actively managed equity funds employ strategies aimed at outperforming a benchmark index, such as the S&P 500. Fund managers conduct extensive research to identify undervalued securities or companies poised for growth. These strategies can include various approaches, such as growth investing (focusing on companies with high growth potential), value investing (seeking companies trading below their intrinsic value), or a blend of both.

Managers actively buy and sell securities, adjusting the portfolio based on their market analysis and predictions. This often involves a higher degree of portfolio turnover compared to index funds. For example, a growth-focused fund might invest heavily in technology companies anticipated to experience rapid expansion, while a value fund might concentrate on established companies with strong fundamentals but relatively low stock prices.

The success of active management hinges on the manager’s skill in identifying market trends and selecting superior investments.

Passive Management in Index Funds

Index funds, in contrast, adopt a passive investment approach. Their primary objective is to mirror the performance of a specific market index. Rather than attempting to beat the market, index funds aim to match its returns. This is achieved by constructing a portfolio that holds the same securities as the index, in the same proportions. For instance, an S&P 500 index fund would hold a proportional representation of the 500 companies comprising the S&P 500 index.

The portfolio’s composition is adjusted only when the index’s constituents change, reflecting a relatively low portfolio turnover. This passive approach minimizes the need for extensive market research and active trading decisions, leading to lower management fees.

Fund Manager Roles: Active vs. Passive

The role of a fund manager differs significantly between actively and passively managed funds. In actively managed equity funds, the fund manager acts as a stock picker, responsible for researching, selecting, and trading securities to outperform the benchmark. They employ various analytical tools and strategies, making crucial decisions that directly impact the fund’s performance. In contrast, the fund manager of an index fund plays a more administrative role.

Their primary responsibility is to ensure the fund accurately replicates the index’s composition and maintain the fund’s low-cost structure. They are less involved in making active investment decisions.

Advantages and Disadvantages of Active vs. Passive Management

The choice between active and passive management involves weighing several factors. The following list summarizes the key advantages and disadvantages of each approach:

- Active Management: Advantages

- Potential for higher returns than the market (though not guaranteed).

- Managerial expertise can potentially identify undervalued opportunities.

- Active Management: Disadvantages

- Higher expense ratios due to active trading and research costs.

- No guarantee of outperforming the market; consistent outperformance is rare.

- Potential for higher risk due to active trading strategies.

- Passive Management: Advantages

- Lower expense ratios compared to actively managed funds.

- Diversification across a broad market segment.

- Generally lower risk due to less frequent trading.

- Passive Management: Disadvantages

- Returns are typically tied to the market’s performance; potential for lower returns than actively managed funds in strong bull markets.

- Less control over individual stock selection.

Suitability for Different Investors

Choosing between equity funds and index funds depends heavily on individual investor characteristics. Understanding your risk tolerance, investment timeline, and financial goals is crucial for making an informed decision that aligns with your overall financial strategy. Failing to consider these factors could lead to suboptimal investment outcomes and unnecessary stress.Factors Influencing Fund Selection

Risk Tolerance

Risk tolerance reflects an investor’s comfort level with the potential for losses in exchange for higher potential returns. Investors with a high risk tolerance are generally more comfortable with the volatility associated with equity funds, which may offer greater growth potential but also carry a higher risk of loss. Conversely, investors with a low risk tolerance may prefer the smoother returns and lower volatility of index funds, prioritizing capital preservation over maximizing potential gains.

For example, a young investor with a long time horizon might tolerate higher risk, while an investor nearing retirement might prioritize capital preservation.

Investment Timeline

The length of time an investor plans to remain invested significantly impacts fund selection. Equity funds, with their higher growth potential, are generally better suited for long-term investors (e.g., those saving for retirement). The longer the time horizon, the more opportunity there is to recover from potential short-term market downturns. Index funds, with their lower volatility, can be suitable for shorter-term investment goals where capital preservation is a higher priority.

Consider a young professional saving for a down payment on a house in five years versus someone saving for retirement thirty years out. The shorter-term investor may prefer the stability of an index fund.

Financial Goals

An investor’s financial goals directly influence the choice between equity and index funds. Aggressive growth goals, such as accumulating significant wealth over a long period, often align well with equity funds. More conservative goals, like preserving capital or generating a steady income stream, may be better served by index funds. For instance, an investor aiming to build a large retirement nest egg might favor equity funds, while someone seeking a stable income stream during retirement might choose index funds.

Investor Profiles and Fund Suitability

Investors should carefully consider their own profiles before making any investment decisions.

| Investor Profile | Risk Tolerance | Investment Timeline | Financial Goals | Suitable Fund Type |

|---|---|---|---|---|

| Young professional, saving for retirement | High | Long-term (30+ years) | Aggressive wealth accumulation | Equity Fund |

| Individual nearing retirement | Low | Short-term (5-10 years) | Capital preservation, income generation | Index Fund |

| Conservative investor, risk-averse | Low | Medium-term (10-20 years) | Moderate growth, capital preservation | Index Fund or Balanced Fund (combination of equity and index) |

| Aggressive investor, seeking high returns | High | Long-term (20+ years) | Significant wealth accumulation | Equity Fund |

Decision-Making Flowchart

A flowchart can help visualize the decision-making process:[Description of Flowchart: The flowchart would begin with a central question: “What is your risk tolerance?” Branching from this would be “High” and “Low.” Each branch would then lead to another question: “What is your investment timeline?” with branches for “Long-term,” “Medium-term,” and “Short-term.” Finally, each of these branches would lead to a recommendation: High risk tolerance and long-term timeline would recommend Equity Funds, while Low risk tolerance and short-term timeline would recommend Index Funds.

Medium risk and medium timeline would suggest a balanced approach or further consideration of financial goals.]

Equity Funds in Detail

Equity funds offer investors a diversified way to participate in the stock market. They pool money from multiple investors to invest in a portfolio of stocks, offering varying levels of risk and potential return depending on their investment strategy and the types of companies they invest in. Understanding the different types of equity funds is crucial for making informed investment decisions.

Types of Equity Funds

Equity funds are categorized based on their investment objectives and strategies. These categories are not mutually exclusive; some funds may blend characteristics from multiple types. The primary classifications include growth funds, value funds, sector funds, and international funds. Each type presents a unique risk-return profile.

Growth Funds

Growth funds primarily invest in companies expected to experience significant earnings growth. These companies often reinvest profits back into the business rather than paying substantial dividends. The investment strategy focuses on identifying companies with strong growth potential, often in emerging industries or technologically advanced sectors. Growth funds typically carry higher risk than value funds due to their focus on potentially volatile, high-growth companies, but they also offer the potential for higher returns.

For example, a growth fund might invest heavily in technology companies developing cutting-edge artificial intelligence solutions, anticipating significant future revenue increases. However, if the technology fails to gain traction or faces stiff competition, the fund’s performance could suffer significantly.

Value Funds

Value funds focus on undervalued companies, which are companies trading at a lower price relative to their fundamental value, such as earnings, assets, or cash flow. The investment strategy involves identifying companies that the fund managers believe are priced below their intrinsic worth. Value funds generally carry lower risk than growth funds, as they tend to invest in more established and financially stable companies.

However, their potential for high returns may be somewhat lower compared to growth funds. A classic example of a value investment strategy might involve purchasing shares of a well-established manufacturing company that is temporarily underperforming due to a short-term economic downturn.

Sector Funds

Sector funds concentrate their investments within a specific industry or economic sector, such as technology, healthcare, or energy. The investment strategy aims to capitalize on growth opportunities within a particular sector. Sector funds offer higher risk due to their concentrated exposure, but they also offer the potential for higher returns if the chosen sector performs well. However, if the chosen sector underperforms, the fund’s performance could suffer significantly.

For instance, a technology sector fund heavily invested in semiconductor manufacturers could experience substantial gains during a period of strong global demand for electronics but might suffer significant losses during a downturn in the semiconductor industry.

International Funds

International funds invest in companies located outside the investor’s home country. The investment strategy involves diversifying geographically to reduce overall portfolio risk and potentially access higher growth opportunities in emerging markets. International funds carry additional risks associated with currency fluctuations, political instability, and differing regulatory environments. However, they also offer the potential for diversification benefits and higher returns if international markets outperform domestic markets.

Investing in a fund focused on emerging Asian markets, for example, presents the potential for high growth but also carries the risk of economic and political instability in those regions.

Comparison of Equity Fund Types

The following table summarizes the key characteristics of three different types of equity funds:

| Characteristic | Growth Fund | Value Fund | Sector Fund (Technology) |

|---|---|---|---|

| Investment Objective | High capital appreciation | Capital appreciation and income | High capital appreciation within the technology sector |

| Investment Strategy | Invest in high-growth companies | Invest in undervalued companies | Invest in technology companies |

| Risk | High | Medium | High |

| Return Potential | High | Medium | High |

| Dividend Payout | Typically low | Can be higher | Variable |

Ultimately, the choice between equity funds and index funds hinges on individual investor profiles and their specific financial objectives. While equity funds offer the potential for higher returns through active management, they also carry a higher level of risk and expense. Index funds, on the other hand, provide a more passive, diversified approach with lower costs and potentially steadier growth.

By carefully weighing the advantages and disadvantages of each, investors can confidently select the investment vehicle that best aligns with their risk tolerance, time horizon, and desired financial outcomes.

User Queries

What is the minimum investment amount for equity and index funds?

Minimum investment amounts vary significantly depending on the specific fund and the brokerage platform. Some funds may have relatively low minimums, while others may require a substantial initial investment.

How often are index funds rebalanced?

Index funds are typically rebalanced periodically, often quarterly or annually, to maintain their alignment with the underlying index. The exact rebalancing frequency varies by fund.

Can I invest in both equity and index funds simultaneously?

Yes, many investors diversify their portfolios by investing in both equity and index funds to balance risk and potential return. This approach allows for a combination of active and passive management strategies.

Are there tax implications for investing in equity and index funds?

Yes, the tax implications depend on factors such as the type of fund, the holding period, and your individual tax bracket. Capital gains taxes may apply upon the sale of fund shares. Consult a financial advisor for personalized tax advice.