Understanding equity fund returns is crucial for any investor navigating the complexities of the financial markets. This analysis delves into the factors driving equity fund performance, exploring both the potential for significant gains and the inherent risks involved. We will examine historical data, risk assessment methodologies, and portfolio diversification strategies to provide a comprehensive overview of this critical aspect of investment management.

From macroeconomic influences like interest rates and inflation to the impact of investor sentiment and market cycles, we’ll dissect the multifaceted nature of equity fund returns. This analysis will equip you with the knowledge to make informed investment decisions, aligning your portfolio with your risk tolerance and financial goals.

Introduction to Equity Funds

Equity funds are investment vehicles that pool money from multiple investors to invest primarily in stocks or shares of publicly traded companies. Their primary objective is to generate capital appreciation for investors through the growth of the underlying stock holdings. Returns are not guaranteed, and losses are possible.Equity funds offer diversification, allowing investors to spread their risk across a portfolio of different companies, rather than investing in a single stock.

This diversification reduces the overall risk compared to holding individual stocks. The performance of an equity fund is directly tied to the performance of the underlying companies in its portfolio and the overall market conditions.

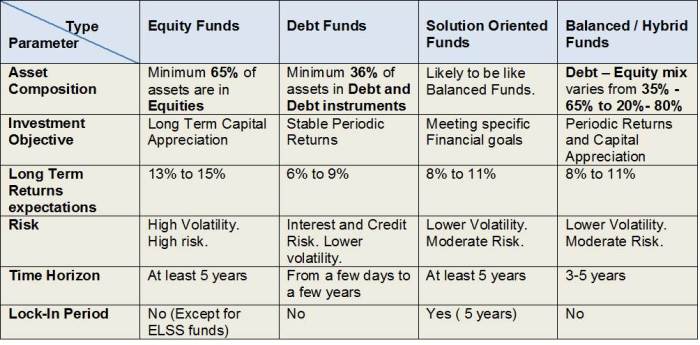

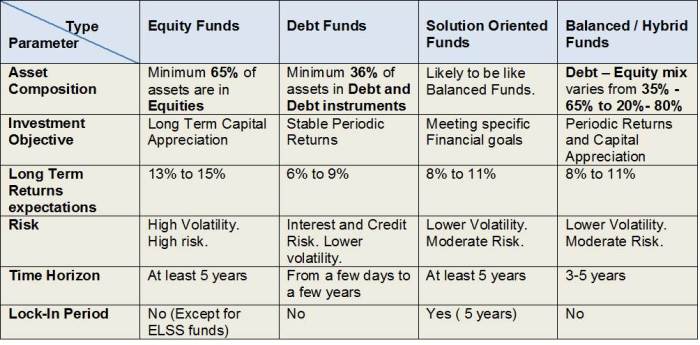

Types of Equity Funds

Equity funds are categorized based on the market capitalization of the companies they invest in, or by their focus on specific sectors. This categorization helps investors choose funds aligned with their risk tolerance and investment goals. For example, an investor with a higher risk tolerance might choose a small-cap fund, while a more conservative investor might prefer a large-cap fund.

- Large-Cap Funds: These funds invest in established, large companies with substantial market capitalization. These companies tend to be more stable and less volatile than smaller companies, resulting in potentially lower growth but also reduced risk.

- Mid-Cap Funds: These funds invest in companies with a market capitalization between large-cap and small-cap companies. They offer a balance between growth potential and risk, often providing a higher growth potential than large-cap funds but with increased volatility.

- Small-Cap Funds: These funds invest in smaller companies with lower market capitalization. These companies typically exhibit higher growth potential but also carry significantly higher risk due to their smaller size and potentially greater volatility.

- Sector-Specific Funds: These funds focus their investments on companies within a particular sector, such as technology, healthcare, or energy. This approach offers targeted exposure to specific industries, but also increases the risk associated with the performance of that particular sector.

Risk Factors Associated with Equity Funds

Investing in equity funds carries inherent risks. While diversification mitigates some risk, it doesn’t eliminate it entirely. Understanding these risks is crucial before investing.

- Market Risk: This is the risk that the overall market will decline, impacting the value of the fund’s holdings. A significant market downturn can lead to substantial losses.

- Company-Specific Risk: This refers to the risk associated with individual companies within the fund’s portfolio. Poor performance or bankruptcy of a single company can negatively affect the fund’s overall return.

- Interest Rate Risk: Changes in interest rates can impact the valuation of stocks, particularly growth stocks that are more sensitive to interest rate fluctuations. Rising interest rates often lead to lower valuations for growth companies.

- Inflation Risk: Inflation erodes the purchasing power of returns. If the fund’s returns don’t outpace inflation, the real return for investors is diminished.

- Currency Risk: For internationally diversified funds, fluctuations in exchange rates can impact the value of foreign investments. A weakening of the domestic currency against foreign currencies can reduce returns.

Factors Influencing Equity Fund Returns

Equity fund returns are influenced by a complex interplay of factors, both internal to the fund’s investment strategy and external, stemming from the broader economic and market environment. Understanding these influences is crucial for investors seeking to make informed decisions and manage their risk effectively. This section will delve into the key macroeconomic factors, market sentiment, and the varying performance of different equity fund categories across market cycles.

Macroeconomic Factors Impacting Equity Fund Performance

Macroeconomic conditions significantly shape the overall investment landscape and, consequently, equity fund returns. Interest rates, inflation, and economic growth are particularly influential. Rising interest rates, for example, can increase borrowing costs for companies, potentially slowing down economic growth and impacting corporate profitability. This, in turn, can negatively affect the value of equities held by equity funds. Conversely, lower interest rates can stimulate economic activity and boost corporate earnings, leading to higher equity valuations.

Inflation erodes purchasing power and can increase input costs for businesses, potentially squeezing profit margins and impacting stock prices. Strong economic growth, on the other hand, usually translates to higher corporate earnings and increased investor confidence, driving up equity prices. The relationship between these factors isn’t always linear; for instance, moderate inflation can sometimes coexist with robust economic growth, while high inflation often leads to higher interest rates to curb it, creating a complex interplay of effects on equity fund returns.

Market Sentiment and Investor Behavior

Market sentiment, encompassing the collective mood and expectations of investors, plays a powerful role in shaping equity fund returns. Periods of optimism and exuberance can lead to inflated valuations, while pessimism and fear can trigger sharp market corrections. Investor behavior, driven by factors like fear, greed, and herd mentality, further amplifies these market swings. For example, during periods of high uncertainty, investors might flock to safer assets, leading to a sell-off in equities and negatively impacting equity fund performance.

Conversely, during periods of strong economic growth and investor confidence, a “fear of missing out” (FOMO) can drive significant capital inflows into equity funds, pushing prices higher. This behavior can create market bubbles or crashes, independent of the underlying fundamentals of the companies within the fund.

Performance of Different Equity Fund Categories Across Market Cycles

Different equity fund categories exhibit varying performance across different market cycles. For example, during periods of economic expansion, growth-oriented funds, which invest in companies expected to experience rapid growth, tend to outperform value-oriented funds, which focus on undervalued companies. However, during economic downturns or periods of market volatility, value funds may offer better downside protection. Similarly, large-cap funds, investing in established, large companies, often display greater stability compared to small-cap funds, which invest in smaller, less established companies, but potentially offering higher growth potential during economic booms.

The performance of sector-specific funds, focused on particular industries like technology or healthcare, is also highly dependent on the cyclical performance of those sectors. For instance, technology funds might perform exceptionally well during periods of technological innovation but underperform during economic slowdowns where technology spending is often reduced. Therefore, understanding the characteristics of different fund categories and their historical performance across various market cycles is crucial for diversification and risk management.

Analyzing Historical Equity Fund Performance

Analyzing historical equity fund performance is crucial for understanding past trends and making informed investment decisions. This involves examining returns across different timeframes, employing relevant performance metrics, and considering the impact of market events. A thorough analysis helps investors assess risk and potential returns, facilitating better portfolio management.

Historical Equity Fund Returns

The table below presents the historical annualized returns for a selection of hypothetical equity funds over 5 and 10-year periods. These figures are for illustrative purposes only and do not represent the performance of any specific funds. Actual returns will vary.

| Fund Name | 5-Year Annualized Return (%) | 10-Year Annualized Return (%) | Standard Deviation (%) |

|---|---|---|---|

| Growth Fund A | 12.5 | 10.0 | 15 |

| Value Fund B | 9.8 | 8.5 | 12 |

| Index Fund C | 11.2 | 9.5 | 14 |

| Small-Cap Fund D | 15.0 | 11.5 | 20 |

Methodology for Comparing Equity Fund Performance

Comparing equity fund performance requires a multi-faceted approach, going beyond simple return comparisons. Several metrics provide valuable insights into risk-adjusted returns and relative performance.We will use the following metrics for comparison:

- Annualized Return: The average annual growth rate of the investment over a specified period. This provides a basic measure of performance but does not account for risk.

- Standard Deviation: A measure of the volatility or risk associated with the fund’s returns. Higher standard deviation indicates greater risk.

- Sharpe Ratio: This risk-adjusted performance metric measures excess return (return above the risk-free rate) per unit of risk (standard deviation). A higher Sharpe ratio indicates better risk-adjusted performance. The formula is:

Sharpe Ratio = (Rp – Rf) / σp

where Rp is the portfolio return, Rf is the risk-free rate, and σp is the portfolio standard deviation.

- Alpha: A measure of a fund’s excess return relative to its benchmark (e.g., a market index). A positive alpha suggests the fund manager outperformed the benchmark, while a negative alpha indicates underperformance.

- Beta: A measure of a fund’s volatility relative to its benchmark. A beta of 1 indicates the fund moves in line with the market, while a beta greater than 1 suggests higher volatility than the market, and a beta less than 1 indicates lower volatility.

Impact of Market Events on Fund Performance

Analyzing historical data allows us to observe how different market events affected fund performance. For example, during periods of high market volatility, like the 2008 financial crisis or the COVID-19 pandemic, funds with higher betas typically experienced larger losses than those with lower betas. Conversely, during periods of strong market growth, funds with higher betas might have also seen higher returns.

Examining these periods reveals the fund’s resilience and risk profile. Analyzing performance during various economic cycles (e.g., recessions, expansions) provides a more comprehensive understanding of a fund’s behavior under diverse market conditions. This analysis helps investors understand the fund’s risk tolerance and potential for growth in different market environments.

Portfolio Construction and Diversification with Equity Funds

Effective portfolio construction is crucial for achieving investment goals while managing risk. Diversification, a cornerstone of sound investment strategy, is readily achieved through equity funds, which offer exposure to a basket of stocks across various sectors and market capitalizations. This allows investors to reduce their reliance on any single company’s performance, mitigating potential losses. By strategically combining different equity fund types, investors can tailor their portfolios to align with their individual risk profiles and financial objectives.Diversified Portfolios Incorporating Different Equity Fund TypesA well-diversified portfolio typically includes a mix of equity fund types to balance risk and return.

For instance, a conservative investor might allocate a significant portion to a large-cap equity fund, known for its relative stability, and a smaller portion to a small-cap fund for growth potential. A more aggressive investor might favor a higher allocation to small-cap and mid-cap funds, accepting greater volatility in pursuit of higher returns. Including international equity funds adds geographic diversification, reducing dependence on the performance of a single national market.

Examples of Diversified Equity Fund Portfolios

The following examples illustrate how different risk tolerances and investment goals translate into varying portfolio allocations:

- Conservative Portfolio (Low Risk): 60% Large-Cap Equity Fund, 30% Bond Fund, 10% Money Market Fund. This portfolio prioritizes capital preservation and stability over high growth.

- Moderate Portfolio (Medium Risk): 40% Large-Cap Equity Fund, 30% Mid-Cap Equity Fund, 20% International Equity Fund, 10% Bond Fund. This balanced approach seeks a blend of growth and stability.

- Aggressive Portfolio (High Risk): 50% Small-Cap Equity Fund, 30% Emerging Markets Equity Fund, 20% Mid-Cap Equity Fund. This portfolio aims for significant growth but accepts substantially higher volatility.

Strategies for Optimizing Portfolio Allocation

Optimizing portfolio allocation involves considering several factors, including the investor’s risk tolerance, time horizon, and financial goals. Risk tolerance reflects an investor’s comfort level with potential losses. A longer time horizon allows for greater risk-taking, as there’s more time to recover from potential downturns. Investment goals, such as retirement planning or purchasing a home, will also influence asset allocation decisions.

Hypothetical Portfolio Design and Rationale

Let’s consider a hypothetical portfolio for a 40-year-old investor with a moderate risk tolerance and a 20-year investment horizon aiming for retirement savings.

| Fund Type | Allocation (%) | Rationale |

|---|---|---|

| Large-Cap US Equity Fund | 35 | Provides a foundation of stability and exposure to established companies. |

| Mid-Cap US Equity Fund | 25 | Offers growth potential from companies with higher growth prospects than large-caps. |

| International Developed Markets Equity Fund | 20 | Diversifies geographically, reducing dependence on the US market. |

| Emerging Markets Equity Fund | 10 | Provides exposure to high-growth potential, albeit with higher risk. |

| Bond Fund | 10 | Reduces overall portfolio volatility and provides a source of income. |

This portfolio balances growth potential with risk mitigation. The allocation to large-cap funds provides stability, while mid-cap and international funds offer growth opportunities. The inclusion of emerging markets adds potential for higher returns but also increases volatility. The bond allocation serves as a buffer against market downturns. This allocation is a suggestion and should be adjusted based on individual circumstances and professional financial advice.

It’s crucial to remember that past performance is not indicative of future results.

Analyzing equity fund returns reveals a dynamic interplay between risk and reward. While past performance doesn’t guarantee future results, understanding historical trends, risk metrics, and diversification strategies empowers investors to make more informed choices. By carefully considering the factors influencing equity fund performance and employing sound portfolio management techniques, investors can strive to achieve their financial objectives while managing risk effectively.

FAQ Guide

What is the difference between a load and no-load equity fund?

Load funds charge a commission or fee when you buy or sell shares, while no-load funds do not.

How often are equity fund returns calculated?

Returns are typically calculated daily, but reported monthly or annually.

What is expense ratio and why is it important?

The expense ratio represents the annual cost of managing the fund. Lower expense ratios generally lead to higher returns for investors.

Can I predict future equity fund returns?

No, future returns are inherently uncertain. Past performance is not indicative of future results.