Navigating the world of equity investments can feel daunting, especially when considering the complexities of 2024’s economic landscape. This guide aims to demystify the process, offering insights into selecting the best equity funds to align with your financial goals and risk tolerance. We will explore various fund types, analyze key market influences, and provide a structured approach to due diligence, ensuring you make informed investment decisions.

Understanding the nuances of large-cap, mid-cap, and small-cap funds, along with sector-specific options, is crucial for building a diversified portfolio. We’ll examine the impact of macroeconomic factors such as inflation and interest rates, and discuss how technological advancements and regulatory changes will shape the market. Ultimately, our goal is to equip you with the knowledge to confidently navigate the investment landscape and build a successful long-term strategy.

Understanding Equity Funds

Equity funds are investment vehicles that pool money from multiple investors to invest primarily in stocks or shares of publicly traded companies. They offer a diversified approach to equity investing, allowing individuals to access a portfolio of stocks without the need for significant individual research and capital outlay. Understanding their characteristics is crucial for making informed investment decisions.

Fundamental Characteristics of Equity Funds

Equity funds are characterized by their investment objective: capital appreciation. This means the primary goal is to increase the value of the investment over time through the growth of the underlying stocks. They offer varying levels of risk and potential return depending on their investment strategy and the types of companies they invest in. Fund managers actively manage these portfolios, buying and selling stocks to achieve the fund’s objectives.

Regular reporting provides investors with transparency into their investments. Expense ratios, reflecting the fund’s operational costs, should be considered when evaluating options.

Types of Equity Funds

Equity funds are categorized based on the market capitalization of the companies they invest in, or by their focus on specific sectors. Large-cap funds invest in established, large companies; mid-cap funds focus on medium-sized companies; and small-cap funds invest in smaller, typically more volatile companies. Sector-specific funds concentrate investments within a particular industry, such as technology, healthcare, or energy.

Thematic funds focus on companies related to a specific theme, like renewable energy or artificial intelligence.

Risk and Reward Profiles of Equity Fund Categories

The risk and reward profile varies significantly across equity fund categories. Large-cap funds generally offer lower risk and more stable returns compared to small-cap funds, which are associated with higher risk and potentially higher returns. Mid-cap funds represent a middle ground. Sector-specific funds carry the risk of underperformance if the chosen sector experiences a downturn. Diversification across different fund categories can help mitigate overall portfolio risk.

For example, a portfolio including both large-cap and small-cap funds might balance stability with growth potential.

Successful Long-Term Equity Fund Investment Strategies

Successful long-term equity fund investment strategies often involve a combination of factors. Diversification across different fund types and sectors is key to reducing risk. A long-term investment horizon allows for weathering market fluctuations and benefiting from the potential for long-term growth. Regular rebalancing of the portfolio can help maintain the desired asset allocation. Dollar-cost averaging, which involves investing a fixed amount at regular intervals regardless of market conditions, can help mitigate the risk of investing a lump sum at a market peak.

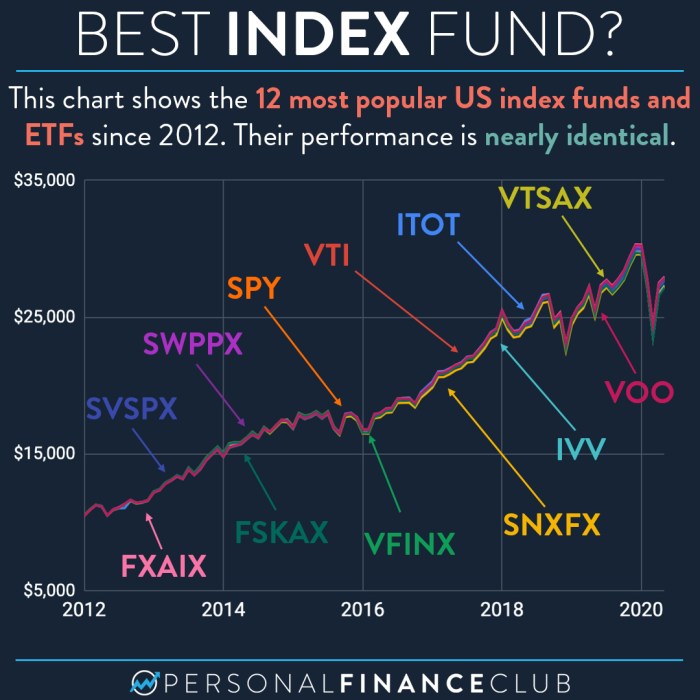

Finally, choosing funds with a proven track record and experienced management teams is crucial. For instance, consistently investing in a diversified portfolio of index funds tracking the S&P 500 over several decades has historically yielded significant returns.

Comparison of Equity Fund Types

| Fund Type | Risk Level | Investment Strategy | Potential Returns |

|---|---|---|---|

| Large-Cap | Low to Moderate | Invest in established, large companies | Moderate |

| Mid-Cap | Moderate | Invest in medium-sized companies | Moderate to High |

| Small-Cap | High | Invest in smaller, growth-oriented companies | High, but with greater volatility |

| Sector-Specific (e.g., Technology) | Moderate to High (depending on sector) | Concentrated investments in a specific sector | High potential, but also high risk if the sector underperforms |

Factors Influencing Equity Fund Performance in 2024

Predicting equity market performance is inherently complex, relying on a confluence of macroeconomic factors, technological advancements, and regulatory shifts. 2024 presents a unique set of challenges and opportunities, requiring a careful consideration of these interwoven influences to effectively navigate the investment landscape. Understanding these factors is crucial for investors seeking to optimize their equity fund portfolios.

Macroeconomic Factors and their Impact

Inflationary pressures, interest rate policies, and geopolitical instability are among the most significant macroeconomic factors likely to shape equity market performance in 2024. Persistently high inflation could erode corporate profitability and investor confidence, leading to market corrections. Conversely, a successful taming of inflation might boost investor sentiment and fuel market growth. Central bank responses, particularly interest rate adjustments, will play a crucial role in influencing borrowing costs for businesses and consumers, impacting investment decisions and overall economic activity.

Geopolitical events, such as ongoing conflicts or escalating trade tensions, introduce significant uncertainty and can trigger volatility in global equity markets. For example, the ongoing war in Ukraine has already significantly impacted energy prices and global supply chains, illustrating the potential for geopolitical risks to negatively impact equity performance.

Technological Advancements and Sectoral Impacts

Rapid technological advancements will continue to reshape various equity sectors in 2024. Artificial intelligence (AI), for instance, is expected to drive significant growth in technology-related companies, while simultaneously impacting other sectors through automation and process optimization. The rise of renewable energy technologies could lead to increased investment in green energy companies and related infrastructure. Conversely, sectors heavily reliant on traditional technologies may face challenges adapting to the changing landscape.

The automotive industry, for example, is undergoing a massive transformation driven by electric vehicle technology, presenting both opportunities and risks for established automakers and new entrants.

Regulatory Changes and their Influence

Regulatory changes at both national and international levels will exert a considerable influence on equity fund investments in 2024. New environmental, social, and governance (ESG) regulations, for example, could lead to increased scrutiny of corporate practices and potentially impact investment decisions in companies with poor ESG ratings. Changes in tax policies or accounting standards can also affect corporate profitability and investor behavior.

Furthermore, increased regulatory oversight of the financial sector could impact the operations and investment strategies of equity funds themselves. The implementation of stricter regulations on data privacy, for example, could impact the technology sector and necessitate significant adjustments to business models.

Potential Risks and Opportunities in the Equity Market for 2024

The following points Artikel some key risks and opportunities investors should consider:

- Risk: Persistent high inflation leading to reduced corporate profitability and market corrections.

- Risk: Unexpected geopolitical events causing market volatility and uncertainty.

- Risk: Increased regulatory scrutiny impacting specific sectors or investment strategies.

- Risk: Rapid technological change disrupting established industries and leading to job displacement.

- Opportunity: Growth potential in sectors driven by technological advancements, such as AI and renewable energy.

- Opportunity: Strong performance from companies successfully adapting to changing consumer preferences and market trends.

- Opportunity: Attractive valuations in sectors experiencing temporary downturns.

- Opportunity: Potential for increased returns from investments in emerging markets with strong growth prospects.

Selecting the Best Equity Funds for 2024

Choosing the right equity funds for 2024 requires a careful evaluation of various factors. This section Artikels a methodology for selecting funds that align with your risk tolerance and investment goals. Remember, past performance is not indicative of future results, but it provides valuable insights.

Evaluating Historical Equity Fund Performance

Analyzing historical performance involves more than just looking at the total return. A comprehensive evaluation considers several key metrics. We should examine the fund’s track record over different market cycles (bull and bear markets) to assess its resilience and consistency. Furthermore, comparing the fund’s performance against its benchmark index (e.g., S&P 500) reveals its ability to generate alpha (excess returns).

Standard deviation, a measure of volatility, helps gauge the fund’s risk profile. Sharpe ratio, which considers risk-adjusted returns, offers a more nuanced view of performance. Finally, a thorough examination of the fund manager’s investment strategy and experience contributes to a complete assessment. For example, a fund consistently outperforming its benchmark over multiple economic cycles suggests a robust strategy.

Conversely, a fund showing high volatility with only marginal outperformance might signal higher risk with limited reward.

Expense Ratios and Management Fees of Equity Funds

Expense ratios and management fees significantly impact a fund’s overall returns. Expense ratios represent the annual cost of owning the fund, expressed as a percentage of assets under management (AUM). Lower expense ratios generally translate to higher net returns for investors. Management fees are a component of the expense ratio, representing compensation for the fund managers. Comparing funds with similar investment objectives, a fund with a lower expense ratio is generally preferred.

For example, a fund with a 1% expense ratio will cost an investor $100 annually for every $10,000 invested, whereas a fund with a 0.5% expense ratio will only cost $50. This seemingly small difference can accumulate to substantial savings over the long term.

The Importance of Diversification in an Equity Fund Portfolio

Diversification is crucial for mitigating risk in an equity portfolio. By investing across different sectors, market caps (large, mid, small), and geographical regions, investors can reduce the impact of any single investment performing poorly. Diversification doesn’t eliminate risk entirely, but it significantly reduces the volatility of the overall portfolio. For example, if a portfolio is heavily concentrated in the technology sector, a downturn in that sector will severely impact the portfolio’s value.

A diversified portfolio, however, is less susceptible to such concentrated risks. A well-diversified portfolio should aim to spread risk across different asset classes and market segments.

Hypothetical Equity Fund Portfolios

The following table presents hypothetical portfolios for risk-averse and risk-tolerant investors. These are examples only and should not be considered investment advice. Individual circumstances and risk tolerance should always guide investment decisions. Remember to consult a financial advisor before making any investment decisions.

| Risk-Averse Investor | Risk-Tolerant Investor |

|---|---|

| 60% Large-Cap Blend Fund (lower volatility) | 30% Small-Cap Growth Fund (higher growth potential) |

| 30% Government Bond Fund (low risk) | 30% Emerging Markets Equity Fund (higher risk, higher potential return) |

| 10% Short-Term Bond Fund (very low risk, high liquidity) | 40% Technology Sector Fund (high growth, high risk) |

Due Diligence and Research

Investing in equity funds requires thorough due diligence to mitigate risk and maximize returns. Understanding the fund manager’s track record, scrutinizing fund documents, and identifying potential red flags are crucial steps in this process. This section details how to conduct effective research and interpret key financial metrics.

Researching Fund Managers

Selecting a fund manager with a proven track record involves more than just looking at past performance. A successful track record should be consistent over various market cycles, demonstrating resilience and adaptability. Investors should examine the manager’s investment philosophy, their team’s expertise, and their tenure with the fund. Consider researching their background, educational qualifications, and any significant awards or recognitions they may have received.

Analyzing their investment approach – whether value, growth, or a blend – is vital to ensure alignment with your own investment goals. For instance, a value investor may consistently outperform during market corrections, while a growth investor might excel during periods of economic expansion. Access to reliable databases of fund manager performance data and professional reviews can assist in this process.

Reviewing Fund Prospectuses and Fact Sheets

Fund prospectuses and fact sheets provide crucial information about a fund’s investment strategy, fees, risks, and past performance. A thorough review should include carefully examining the investment objectives, asset allocation, and risk profile. Pay close attention to the expense ratio, which represents the annual cost of managing the fund. A high expense ratio can significantly impact long-term returns.

Understanding the fund’s benchmark and its performance relative to the benchmark is also important. Fact sheets often provide a concise summary of key information, but the prospectus provides a more detailed and comprehensive overview. For example, the prospectus will detail the fund’s holdings, investment strategies, and risk factors in much greater detail than the fact sheet. Compare several prospectuses to identify potential differences in management fees, expense ratios, and risk profiles.

Identifying Red Flags

Several red flags can indicate potential problems with an equity fund. High portfolio turnover, frequent changes in fund managers, inconsistent performance, and unexplained losses are all cause for concern. Furthermore, a fund with a complex or opaque investment strategy can be a red flag. Lack of transparency in fee structures or inconsistent reporting practices should also raise questions.

For instance, a fund consistently underperforming its benchmark over several years without a clear explanation should be investigated further. Similarly, significant changes in the fund’s investment strategy without adequate justification warrant careful consideration.

Interpreting Key Financial Metrics

Several key financial metrics help assess equity fund performance. The Sharpe ratio measures risk-adjusted return, indicating how much excess return a fund generates for each unit of risk taken. A higher Sharpe ratio generally suggests better performance. The formula for the Sharpe ratio is:

Sharpe Ratio = (Rp – Rf) / σp

where Rp is the portfolio return, Rf is the risk-free rate of return, and σp is the portfolio standard deviation. Alpha measures a fund’s excess return compared to its benchmark, while beta measures the fund’s volatility relative to the market. A high alpha suggests superior stock-picking ability, while a beta greater than 1 indicates higher volatility than the market.

These metrics, however, should be interpreted in context and not in isolation. For example, a fund with a high alpha might also have a high beta, indicating higher risk. Therefore, a holistic assessment is necessary.

Long-Term Investment Strategies

Investing in equity funds is a journey, not a sprint. A long-term perspective is crucial for navigating market fluctuations and realizing the potential for significant growth. Short-term market volatility can be unsettling, but over the long haul, equities have historically delivered higher returns compared to other asset classes. Understanding this principle and adopting appropriate strategies is key to successful equity fund investing.A long-term investment horizon, typically defined as 5-10 years or more, allows you to ride out market downturns and benefit from the eventual upward trends.

This approach significantly reduces the impact of short-term market corrections on your overall investment returns. By staying invested, you participate in the market’s recovery and benefit from the power of compounding.

The Importance of a Long-Term Investment Horizon

A long-term investment approach in equity funds minimizes the impact of short-term market volatility. Market fluctuations are inevitable; however, over the long term, the market generally trends upwards. Consider the historical performance of major market indices: while there have been periods of decline, the overall trend has been positive. This makes a long-term approach more likely to achieve your financial goals.

For instance, an investor who invested in the S&P 500 index in 1984 and held it until 2024 would have experienced significant growth despite numerous market corrections during that period.

Dollar-Cost Averaging and Systematic Investment Plans (SIPs)

Dollar-cost averaging (DCA) and systematic investment plans (SIPs) are effective strategies for mitigating risk and maximizing returns over the long term. DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This reduces the risk of investing a lump sum at a market peak. SIPs are a similar concept, commonly used in mutual funds, where a fixed amount is automatically invested at regular intervals.For example, imagine investing $100 per month into an equity fund for 10 years.

During periods of market downturn, you buy more units at lower prices, and during market highs, you buy fewer units at higher prices. Over time, your average cost per unit is likely to be lower than if you had invested the entire lump sum at one time. This strategy smooths out the impact of market volatility and reduces the risk of significant losses.

Risk Management and Loss Mitigation Strategies

Managing risk is paramount in equity fund investing. Diversification across various sectors and asset classes is crucial to reduce the impact of any single investment’s underperformance. A well-diversified portfolio reduces overall volatility and improves the likelihood of achieving your investment goals. Regular portfolio rebalancing helps maintain your desired asset allocation.Furthermore, it is vital to understand your own risk tolerance and align your investment strategy accordingly.

Investing in funds with lower risk profiles, such as large-cap funds, might be suitable for risk-averse investors. Conversely, investors with a higher risk tolerance might consider mid-cap or small-cap funds, which offer higher potential returns but also come with greater volatility.

A Comprehensive Long-Term Investment Plan

- Define Financial Goals: Clearly Artikel your long-term financial objectives (e.g., retirement, education, down payment).

- Determine Investment Horizon: Establish a realistic timeframe for your investments (e.g., 10, 15, or 20 years).

- Assess Risk Tolerance: Understand your comfort level with market fluctuations and choose investments accordingly.

- Diversify Investments: Spread your investments across different asset classes and sectors to reduce risk.

- Implement DCA or SIPs: Invest regularly, regardless of market conditions, to average your cost basis.

- Monitor and Rebalance Portfolio: Regularly review your portfolio’s performance and adjust your asset allocation as needed.

- Stay Informed: Keep abreast of market trends and economic conditions to make informed investment decisions.

- Seek Professional Advice: Consider consulting a financial advisor for personalized guidance.

Investing in equity funds requires careful consideration of various factors, from understanding the different fund types and their risk profiles to conducting thorough due diligence on fund managers. By employing a well-defined investment strategy, diversifying your portfolio, and maintaining a long-term perspective, you can significantly increase your chances of achieving your financial objectives. Remember that professional financial advice is always recommended before making any investment decisions.

Frequently Asked Questions

What is the minimum investment amount for equity funds?

Minimum investment amounts vary widely depending on the fund and the platform you use. Some funds may have minimums as low as a few hundred dollars, while others may require thousands.

How often should I review my equity fund portfolio?

Regular review is crucial, ideally at least annually, or more frequently if market conditions change significantly. This allows for adjustments to your investment strategy based on performance and changing goals.

What are the tax implications of investing in equity funds?

Tax implications depend on your jurisdiction and the specific fund. Capital gains taxes are typically applicable when you sell your shares at a profit. Consult a tax professional for personalized advice.

Can I withdraw money from my equity fund before the maturity date?

Most equity funds don’t have a fixed maturity date. You can usually withdraw money at any time, but early withdrawals may incur penalties or fees depending on the fund’s rules.