Navigating the world of investments can feel daunting, but understanding S&P 500 equity funds offers a compelling entry point. These funds, mirroring the performance of 500 large-cap US companies, provide a diversified approach to investing in the American economy. This guide explores their composition, performance, risk factors, and how they fit within a broader investment strategy, equipping you with the knowledge to make informed decisions.

We will delve into the nuances of various fund types, including index funds and ETFs, comparing their expense ratios and historical performance. Understanding the impact of market volatility and economic indicators on these funds is crucial, and we’ll examine these factors in detail. Finally, we’ll explore how to integrate S&P 500 equity funds into a well-diversified portfolio, considering your personal risk tolerance and investment goals.

S&P 500 Equity Funds and Portfolio Diversification

S&P 500 equity funds offer a straightforward way to gain exposure to a broad swathe of the largest US companies. This broad exposure is a key component in building a diversified investment portfolio, mitigating risk and potentially enhancing returns. Understanding how these funds fit into different investment strategies and alongside other asset classes is crucial for effective portfolio construction.

S&P 500 Equity Funds and Portfolio Diversification Strategies

Investing in an S&P 500 index fund immediately diversifies your holdings across hundreds of companies representing various sectors of the US economy. This inherent diversification reduces the risk associated with investing in individual stocks, where a single company’s underperformance could significantly impact your returns. Instead of relying on the success of a few select companies, your investment is spread across a large basket of stocks, smoothing out volatility and reducing the potential for substantial losses.

This approach is particularly beneficial for investors with a lower risk tolerance.

The Role of S&P 500 Equity Funds in Passive and Active Investing

S&P 500 equity funds are cornerstones of passive investing strategies. Passive investors aim to match the market’s return by holding a broadly diversified portfolio that mirrors a specific index, like the S&P 500. Low-cost index funds or ETFs tracking the S&P 500 are perfectly suited for this approach. In contrast, active investors attempt to outperform the market by selecting individual stocks or actively managed funds.

Even active investors might incorporate an S&P 500 fund as a core holding, providing a stable foundation while they pursue more aggressive strategies with other portions of their portfolio. The S&P 500 fund serves as a benchmark against which their active strategies can be measured.

Integrating S&P 500 Equity Funds into a Well-Diversified Portfolio

A well-diversified portfolio considers multiple asset classes to balance risk and reward. An S&P 500 equity fund forms a crucial part of this strategy, providing exposure to US large-cap equities. However, it’s important to complement this with other asset classes to reduce overall portfolio volatility. For example, incorporating bonds, international equities, and real estate can significantly enhance diversification.

The specific allocation to each asset class will depend on individual risk tolerance, investment goals, and time horizon. A younger investor with a longer time horizon might allocate a larger percentage to equities, while an older investor nearing retirement might favor a more conservative allocation with a higher percentage in bonds.

Comparing Diversification Benefits with Other Asset Classes

While S&P 500 funds offer excellent diversification within the US equity market, they don’t offer diversification across all asset classes. Bonds, for instance, typically have a negative correlation with stocks, meaning they tend to perform well when stocks underperform, and vice versa. This negative correlation helps to cushion the impact of market downturns on the overall portfolio. Similarly, real estate often exhibits different performance patterns compared to stocks, providing further diversification benefits.

International equities also provide diversification by reducing exposure to the performance of the US economy alone. Therefore, a truly diversified portfolio needs a mix of asset classes, with S&P 500 funds forming a significant, but not exclusive, component.

Sample Diversified Portfolio

The following table illustrates a sample diversified portfolio, highlighting the role of an S&P 500 equity fund alongside other asset classes. This is merely an example, and the optimal allocation will vary based on individual circumstances.

| Asset Class | Allocation (%) | Rationale | Example |

|---|---|---|---|

| S&P 500 Equity Fund | 40 | Provides broad exposure to large-cap US equities. | Vanguard S&P 500 ETF (VOO) |

| International Equities | 20 | Reduces dependence on US market performance. | Vanguard Total International Stock ETF (VXUS) |

| Bonds | 30 | Offers stability and counterbalances equity risk. | Vanguard Total Bond Market ETF (BND) |

| Real Estate | 10 | Provides diversification and potential for inflation hedging. | REIT ETF (VNQ) |

Factors Influencing Investment Decisions in S&P 500 Equity Funds

Investing in S&P 500 equity funds offers a diversified approach to the U.S. stock market, but careful consideration of several key factors is crucial for successful investment. Understanding your personal circumstances and the fund’s characteristics is paramount to making informed decisions and achieving your financial goals.

Investment Timeline, Risk Tolerance, and Financial Goals

Before investing in any S&P 500 equity fund, investors should clearly define their investment timeline, risk tolerance, and financial goals. The length of time you plan to invest significantly impacts your risk tolerance. A longer timeline allows for greater potential recovery from market downturns, justifying a higher-risk approach. Conversely, shorter timelines necessitate a more conservative strategy. Risk tolerance reflects your comfort level with potential losses.

Financial goals, whether retirement planning, a down payment on a house, or education funding, should directly influence your investment choices. For example, a long-term retirement investor may tolerate more risk than someone saving for a short-term purchase.

The Importance of Due Diligence in Fund Selection

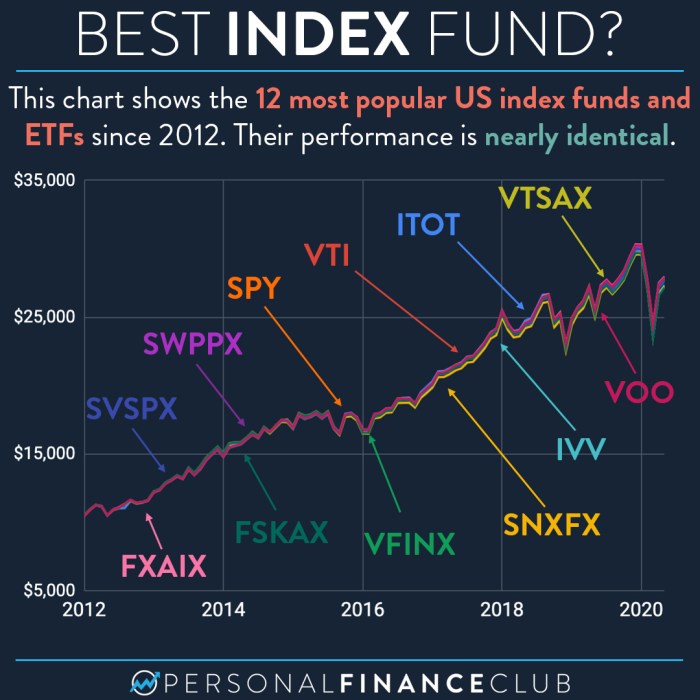

Due diligence is essential when choosing an S&P 500 equity fund. This involves thoroughly researching various funds to identify the best fit for your individual needs. Key aspects to examine include the fund’s expense ratio, historical performance, investment strategy, and portfolio holdings. Comparing multiple funds across these metrics helps in making a well-informed decision. For example, comparing the expense ratios of two similar funds can reveal significant differences in long-term returns.

A fund with a lower expense ratio generally outperforms a higher-expense fund over the long term, all else being equal.

Impact of Fees and Expenses on Long-Term Returns

Fees and expenses significantly impact the long-term returns of S&P 500 equity funds. These costs, including expense ratios and management fees, are deducted from the fund’s assets, directly reducing your investment returns. Even seemingly small differences in expense ratios can compound over time, leading to substantial differences in final returns. For example, a 1% difference in the expense ratio over 20 years can result in a significant reduction in your final investment value.

Therefore, selecting a fund with a low expense ratio is a crucial aspect of maximizing returns.

A Step-by-Step Guide to Researching and Selecting an S&P 500 Equity Fund

Selecting the right S&P 500 equity fund requires a systematic approach. Following these steps can help investors make an informed decision.

- Define your investment goals and timeline: Clearly articulate your financial objectives and how long you plan to invest.

- Assess your risk tolerance: Determine your comfort level with potential market fluctuations.

- Research potential funds: Use reputable sources like Morningstar or Fidelity to compare various S&P 500 index funds.

- Analyze expense ratios and fees: Compare expense ratios to identify funds with lower costs.

- Review historical performance: Examine past performance, but remember that past performance is not indicative of future results.

- Consider the fund’s investment strategy and portfolio holdings: Understand how the fund invests and its diversification approach.

- Read the fund’s prospectus: This document provides detailed information about the fund’s investment objectives, risks, and fees.

- Make your investment decision: Based on your research, choose the fund that best aligns with your goals and risk tolerance.

Investing in S&P 500 equity funds presents a powerful avenue for participation in the US stock market, offering both diversification and potential for growth. However, thorough research and understanding of inherent risks are paramount. By carefully considering your investment timeline, risk tolerance, and financial objectives, and by comparing different fund options, you can confidently incorporate S&P 500 equity funds into a strategy aligned with your individual financial aspirations.

Remember, professional financial advice is always recommended before making any investment decisions.

FAQs

What is the minimum investment amount for S&P 500 equity funds?

Minimum investment amounts vary significantly depending on the fund and the brokerage. Some funds have no minimum, while others may require thousands of dollars.

Are S&P 500 equity funds suitable for all investors?

No, S&P 500 funds carry market risk. Suitability depends on individual risk tolerance, investment timeline, and financial goals. Conservative investors may prefer less volatile options.

How are dividends from S&P 500 equity funds handled?

Dividends are typically reinvested automatically to purchase more shares, or they can be paid out to the investor, depending on the fund’s distribution policy and the investor’s preference.

What are the tax implications of investing in S&P 500 equity funds?

Capital gains taxes apply to profits when you sell your shares. Dividend income may also be taxable depending on your tax bracket and the fund’s structure. Consult a tax professional for personalized advice.