Navigating the world of investments can be daunting, especially when considering tax optimization. Equity-linked savings schemes (ELSS), a type of equity fund, offer a compelling solution for tax-conscious investors. These funds provide the potential for long-term capital appreciation while offering tax benefits under Section 80C of the Income Tax Act. This exploration delves into the intricacies of ELSS funds, guiding you through the selection process, risk assessment, and the potential rewards of incorporating them into your investment strategy.

Understanding the nuances of ELSS funds requires a balanced perspective. While they offer attractive tax advantages, they are subject to market risks, similar to other equity investments. This guide aims to provide a comprehensive overview, equipping you with the knowledge necessary to make informed decisions that align with your financial goals and risk tolerance. We’ll cover everything from understanding the different types of ELSS funds to analyzing fund performance and mitigating potential risks.

Introduction to Equity Funds for Tax Saving

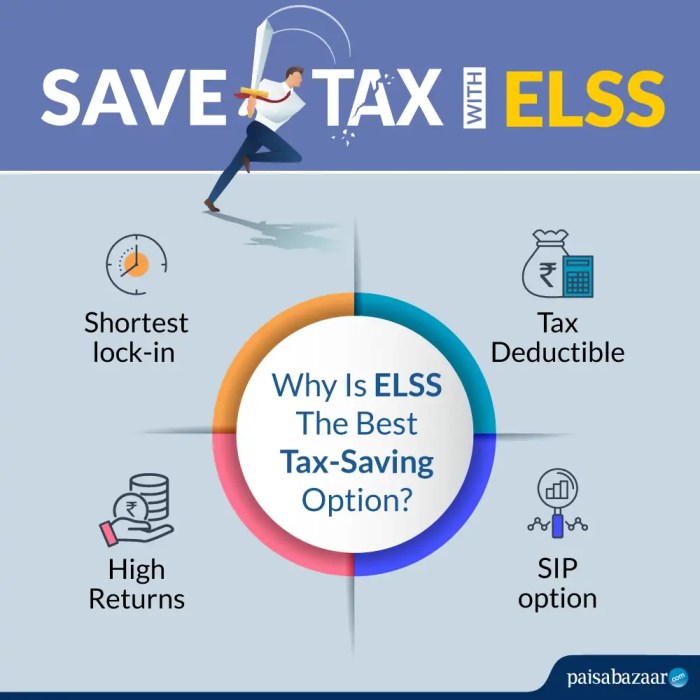

Equity-linked savings schemes (ELSS) are a type of mutual fund that invests primarily in equities. They offer a unique blend of market-linked returns and tax benefits under Section 80C of the Income Tax Act of India, making them an attractive option for tax-saving investments. Understanding their mechanics and the various options available is crucial for making informed investment decisions.ELSS funds provide a significant tax advantage by allowing investors to deduct the amount invested (up to ₹1.5 lakhs annually) from their taxable income.

This directly reduces your tax liability, effectively increasing your post-tax returns. This deduction is in addition to other deductions under Section 80C, offering a substantial opportunity for tax optimization.

Types of ELSS Funds

Different ELSS funds employ diverse investment strategies, leading to variations in their risk profiles and potential returns. Some focus on large-cap companies, offering relatively stable returns, while others might concentrate on mid-cap or small-cap stocks, potentially offering higher growth but with increased volatility. Investors should carefully consider their risk tolerance and financial goals when selecting an ELSS fund.

For example, an ELSS fund focused on large-cap stocks might be suitable for a risk-averse investor seeking steady returns, while an investor with a higher risk tolerance and a longer investment horizon might consider an ELSS fund investing in a mix of large, mid, and small-cap companies. Another example could be an ELSS fund that employs a thematic approach, focusing on specific sectors like technology or renewable energy, which can offer both growth potential and diversification benefits.

It’s crucial to remember that past performance is not indicative of future results, and market fluctuations can impact the returns of any equity investment.

Understanding Equity Funds

Equity funds invest primarily in stocks, aiming to generate long-term capital appreciation. Their investment strategy hinges on selecting companies believed to have strong growth potential, and the fund manager’s expertise plays a crucial role in stock selection and portfolio diversification. Understanding the intricacies of equity funds is essential for investors seeking to build wealth through the stock market.

Equity Fund Investment Strategies

Equity fund managers employ various strategies to achieve their investment objectives. These strategies can range from focusing on specific market sectors (like technology or healthcare) to employing fundamental analysis (assessing a company’s intrinsic value) or quantitative analysis (using statistical models to identify undervalued stocks). Some funds might adopt a growth-oriented strategy, targeting companies with high growth potential, while others might favor value investing, focusing on companies perceived as undervalued by the market.

The chosen strategy significantly impacts the fund’s performance and risk profile. A fund’s investment mandate, clearly Artikeld in its offer document, provides crucial insight into its strategy.

Risk Factors Associated with Equity Fund Investments

Investing in equity funds carries inherent risks. Market volatility is a primary concern; stock prices can fluctuate significantly due to various economic, political, and company-specific factors. This volatility can lead to short-term losses, although long-term growth potential often outweighs these risks. Another key risk is the potential for company-specific issues, such as financial distress or management changes, impacting the value of individual holdings within the fund.

Diversification within a fund, and across different investment assets, is a key strategy to mitigate these risks. It is important to understand your risk tolerance before investing in equity funds.

Comparison of Equity Funds with Other Investment Options

Equity funds offer the potential for higher returns compared to other investment options like debt funds or fixed deposits, but this comes with higher risk. Debt funds, which invest in fixed-income securities like bonds, offer lower returns but generally lower risk. Fixed deposits provide a guaranteed return with minimal risk, but their returns are typically lower than those offered by equity funds.

The choice depends on an investor’s risk tolerance and investment goals. For example, a young investor with a long-term horizon might be more comfortable with the higher risk of equity funds to achieve higher returns, while an investor closer to retirement might prefer the stability of debt funds or fixed deposits.

Key Features of Different Equity Fund Categories

The following table compares key features of various equity fund categories. Understanding these differences is crucial for aligning your investment choices with your risk profile and financial goals.

| Fund Category | Investment Focus | Risk Level | Potential Return |

|---|---|---|---|

| Large-Cap Funds | Established, large market capitalization companies | Relatively Lower | Moderate |

| Mid-Cap Funds | Mid-sized companies with growth potential | Moderate | Potentially Higher |

| Small-Cap Funds | Small companies with high growth potential | Higher | Potentially High, but also higher risk of loss |

| Multi-Cap Funds | Companies across all market capitalizations | Moderate | Balanced potential for growth and stability |

Factors to Consider Before Investing

Investing in Equity Linked Savings Schemes (ELSS) offers tax benefits, but careful consideration of several factors is crucial for successful investing and achieving your financial goals. A well-informed approach minimizes risk and maximizes returns.

Investment Goals and Risk Tolerance

Understanding your investment objectives and risk appetite is paramount before choosing an ELSS fund. Are you saving for retirement, your child’s education, or a down payment on a house? Each goal has a different time horizon, influencing your risk tolerance. A longer time horizon allows for greater risk-taking, potentially leading to higher returns, while shorter-term goals necessitate a more conservative approach.

For example, someone saving for retirement in 20 years might comfortably invest in a higher-growth ELSS fund with a higher risk profile, whereas someone saving for a down payment in three years might prefer a more stable, lower-risk option. Determining your risk profile – conservative, moderate, or aggressive – guides your fund selection.

Fund Manager’s Track Record and Expense Ratio

The fund manager’s experience and the fund’s historical performance are important indicators, but past performance is not indicative of future results. Analyzing a fund manager’s investment philosophy, their team’s expertise, and their consistent performance over several market cycles provides a better understanding of their capabilities. Consider the fund’s expense ratio, which represents the annual cost of managing the fund.

Lower expense ratios generally translate to higher returns for investors. For example, a fund with a 2% expense ratio will deduct 2% of your investment value annually, impacting your overall returns.

Portfolio Diversification

Diversification is key to mitigating risk. Investing solely in ELSS funds may not be optimal. A diversified portfolio includes various asset classes, such as equity, debt, and gold, to balance risk and returns. A hypothetical portfolio might allocate 20% to ELSS funds for tax benefits and long-term growth, 40% to diversified equity funds for broader market exposure, 30% to debt instruments like bonds for stability and income, and 10% to gold for inflation hedging.

This diversification reduces the impact of poor performance in any single asset class.

Fund Expense Ratios and Their Impact on Returns

Understanding fund expense ratios is crucial for maximizing returns.

- Expense Ratio: This is the annual fee charged by the fund manager to manage the fund’s investments. It’s expressed as a percentage of your investment.

- Impact on Returns: A higher expense ratio directly reduces your overall returns. Even a seemingly small difference in expense ratios can significantly impact your investment’s growth over the long term.

- Comparison: Always compare the expense ratios of different ELSS funds before investing. Choose funds with lower expense ratios, all other factors being equal.

- Example: Consider two ELSS funds with identical returns, but one has a 1.5% expense ratio, and the other has a 2.5% expense ratio. Over time, the fund with the lower expense ratio will yield significantly higher returns.

Choosing the Right ELSS Fund

Selecting the right ELSS fund requires careful consideration of your financial goals, risk tolerance, and investment horizon. A systematic approach, focusing on key performance indicators and fund characteristics, can significantly improve your chances of success. This section provides a structured approach to guide you through the process.

Step-by-Step Guide to ELSS Fund Selection

Choosing an ELSS fund involves understanding your investment needs and aligning them with the fund’s characteristics. Begin by clearly defining your investment objectives and risk profile. Then, research potential funds, comparing their performance and expense ratios. Finally, make an informed decision based on your analysis.

- Define Investment Objectives and Risk Tolerance: Determine your financial goals (e.g., retirement, child’s education) and the time horizon for achieving them. Assess your risk tolerance – are you comfortable with potential short-term fluctuations in return for potentially higher long-term gains, or do you prefer a more conservative approach?

- Research Potential ELSS Funds: Use online resources, financial advisors, and fund fact sheets to identify ELSS funds that align with your objectives and risk tolerance. Consider factors like the fund’s investment strategy (large-cap, mid-cap, or small-cap focus), historical performance, expense ratio, and fund manager’s experience.

- Compare Fund Performance and Expense Ratios: Analyze the fund’s past performance over different time periods (e.g., 3 years, 5 years, 10 years). However, remember that past performance is not indicative of future results. Compare expense ratios, as lower expense ratios generally translate to higher returns for investors. Utilize websites and financial portals that offer comparative analysis of mutual funds.

- Analyze Fund Fact Sheets and Key Performance Indicators (KPIs): Examine the fund fact sheet carefully. Pay close attention to KPIs such as the fund’s Standard Deviation (a measure of risk), Sharpe Ratio (risk-adjusted return), and Alpha (a measure of the fund manager’s skill). A higher Sharpe Ratio generally indicates better risk-adjusted performance.

- Make an Informed Decision: Based on your research and analysis, select an ELSS fund that best aligns with your investment goals and risk tolerance. Remember to diversify your investments across different asset classes to mitigate risk.

Examples of Successful ELSS Investment Strategies

Successful ELSS investment strategies often involve a long-term perspective and a disciplined approach to investing. Consider these examples:

- Systematic Investment Plan (SIP): Investing a fixed amount regularly through an SIP helps average out the cost of investment over time, reducing the impact of market volatility. For example, investing ₹5,000 monthly in an ELSS fund over 10 years can yield significant returns, even if the market experiences fluctuations during that period.

- Long-Term Holding: ELSS funds are designed for long-term growth, typically with a lock-in period of three years. Holding the investment for the long term allows the benefits of compounding to accumulate, leading to potentially higher returns. An investor who invested in a top-performing ELSS fund ten years ago and held it through market cycles would likely see substantial growth.

- Diversification Across ELSS Funds: While focusing on a single fund might seem appealing, diversifying across two or three ELSS funds with different investment strategies can help reduce overall portfolio risk. This approach allows you to benefit from different market segments.

Performance Comparison of Different ELSS Funds

Comparing the performance of different ELSS funds requires careful consideration of various factors, including the fund’s investment strategy, expense ratio, and the time period under consideration. Direct comparison of raw return numbers without considering these factors can be misleading. For instance, a fund with a higher expense ratio might show lower returns compared to a lower expense ratio fund, even if both have similar investment strategies.

Reliable financial websites and independent research firms provide comprehensive data on ELSS fund performance.

Analyzing Fund Fact Sheets and Identifying Key Performance Indicators

Fund fact sheets provide a wealth of information about an ELSS fund’s performance and characteristics. Key performance indicators (KPIs) to focus on include:

- Expense Ratio: This indicates the annual cost of managing the fund. Lower expense ratios are generally preferable.

- Net Asset Value (NAV): This represents the current market value of the fund’s assets per unit.

- Returns (1-year, 3-year, 5-year): Past performance data, though not indicative of future results, provides a benchmark for comparison.

- Standard Deviation: A measure of the fund’s volatility or risk. Higher standard deviation implies higher risk.

- Sharpe Ratio: Measures risk-adjusted return. A higher Sharpe Ratio suggests better performance relative to risk.

- Beta: Measures the fund’s volatility relative to the market. A beta of 1 indicates the fund moves in line with the market.

Investing in ELSS funds presents a strategic approach to tax planning and wealth creation. By carefully considering your risk tolerance, investment horizon, and financial objectives, you can harness the potential of ELSS funds to achieve your financial goals while minimizing your tax burden. Remember, diligent research, diversification, and a long-term perspective are key to maximizing the benefits of ELSS investments.

This comprehensive overview serves as a starting point for your journey toward informed and successful investment decisions.

Popular Questions

What is the lock-in period for ELSS funds?

The lock-in period for ELSS funds is typically three years from the date of investment. You cannot withdraw your investments before this period without incurring penalties.

Can I invest in ELSS funds through a SIP (Systematic Investment Plan)?

Yes, you can invest in ELSS funds through a Systematic Investment Plan (SIP), allowing for regular, smaller investments over time.

How do I choose the right ELSS fund for my needs?

Consider your risk tolerance, investment goals, and time horizon. Compare funds based on their past performance, expense ratios, and fund manager’s track record. Diversification across different ELSS funds is also recommended.

Are ELSS funds suitable for all investors?

No, ELSS funds carry market risk, and their suitability depends on individual risk tolerance and financial goals. Investors with a longer time horizon and higher risk tolerance are generally better suited for ELSS funds.