Investing wisely requires careful consideration of historical performance. Understanding which equity funds have consistently delivered strong returns over time is crucial for building a robust investment portfolio. This exploration delves into the factors contributing to success, examining key performance indicators, market influences, and risk management strategies employed by top-performing funds. We’ll analyze different fund types and investment approaches to help you navigate the complexities of equity investing.

This analysis will equip you with the knowledge to identify potentially high-performing equity funds, while also highlighting the inherent risks involved. Understanding the interplay between market cycles, macroeconomic factors, and fund management expertise is paramount in making informed investment decisions. We’ll provide a framework for evaluating historical data and considering your individual risk tolerance.

Defining Equity Funds

Equity funds are investment vehicles that pool money from multiple investors to invest primarily in stocks or shares of publicly traded companies. These funds offer diversification, professional management, and relatively easy access to the equity markets, making them a popular choice for both individual and institutional investors. Their performance is directly tied to the performance of the underlying companies in their portfolio.Equity funds are characterized by their higher potential for growth compared to other investment options, but they also carry a higher level of risk.

Returns can fluctuate significantly depending on market conditions and the specific companies held within the fund. Investors should carefully consider their risk tolerance before investing in equity funds.

Types of Equity Funds

Equity funds are categorized in several ways, primarily based on the market capitalization of the companies they invest in. Understanding these categories is crucial for aligning your investment strategy with your risk appetite and financial goals.

- Large-Cap Funds: These funds invest in established, large companies with a high market capitalization (typically above $10 billion). They generally offer more stability and lower volatility compared to other equity fund types.

- Mid-Cap Funds: These funds focus on companies with a market capitalization between $2 billion and $10 billion. They offer a balance between growth potential and stability, potentially providing higher returns than large-cap funds but with increased volatility.

- Small-Cap Funds: These funds invest in smaller companies with a market capitalization typically below $2 billion. They carry higher risk but also offer the potential for significant growth, as these companies are often experiencing rapid expansion.

Beyond market capitalization, equity funds can also be categorized by sector. Sector-specific funds focus their investments on companies within a particular industry (e.g., technology, healthcare, energy). This approach allows investors to target specific sectors they believe have strong growth potential, but it also increases concentration risk.

Examples of Equity Fund Categories and Investment Strategies

Numerous equity funds exist, each with a unique investment strategy. For instance, a growth fund aims for capital appreciation by investing in companies expected to experience significant growth, often prioritizing companies with high price-to-earnings ratios. Conversely, a value fund seeks undervalued companies with strong fundamentals, often those with lower price-to-earnings ratios. Index funds passively track a specific market index, aiming to mirror its performance.

Examples include funds that track the S&P 500 (a large-cap index) or the Russell 2000 (a small-cap index).

Equity Funds Versus Other Investment Options

Compared to bonds, which offer relatively lower returns but greater stability, equity funds present a higher risk-reward profile. Bonds generally offer a fixed income stream and are considered less volatile than equities. Real estate investments, another alternative, can provide diversification and potential appreciation, but they are typically less liquid than equity funds and require more management. The best choice depends on individual circumstances, risk tolerance, and financial goals.

A diversified portfolio often includes a mix of equity funds, bonds, and other asset classes to balance risk and return.

Historical Performance Metrics

Understanding the historical performance of equity funds is crucial for potential investors. Analyzing past performance, however, shouldn’t be the sole determinant of investment decisions; it’s just one piece of the puzzle. A thorough assessment requires considering various factors alongside historical data.Analyzing historical performance involves examining several key performance indicators (KPIs) to gauge the fund’s success over time. This analysis provides insights into the fund manager’s investment strategy and its effectiveness in generating returns while managing risk.

Key Performance Indicators for Equity Funds

Several key metrics are used to evaluate equity fund performance. These metrics provide a comprehensive view, allowing investors to compare different funds and assess their risk-adjusted returns. Some of the most commonly used KPIs include annualized return, standard deviation, Sharpe ratio, and maximum drawdown. Annualized return reflects the average annual growth rate of an investment over a specific period.

Standard deviation measures the volatility or risk associated with the investment. The Sharpe ratio helps investors compare the risk-adjusted return of different investments. Maximum drawdown represents the largest percentage decline from a peak to a trough in the value of an investment.

Importance of Different Timeframes

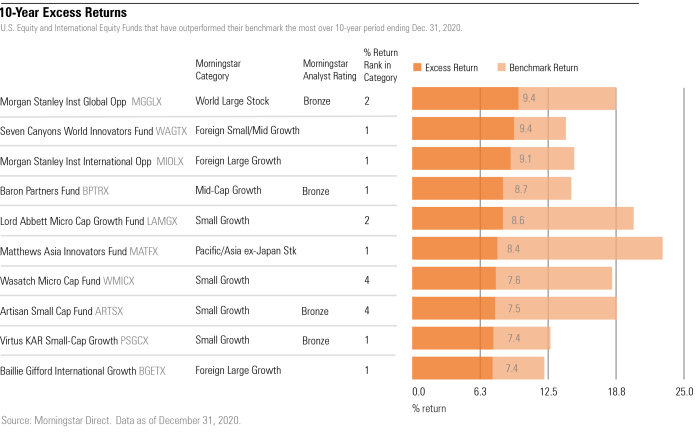

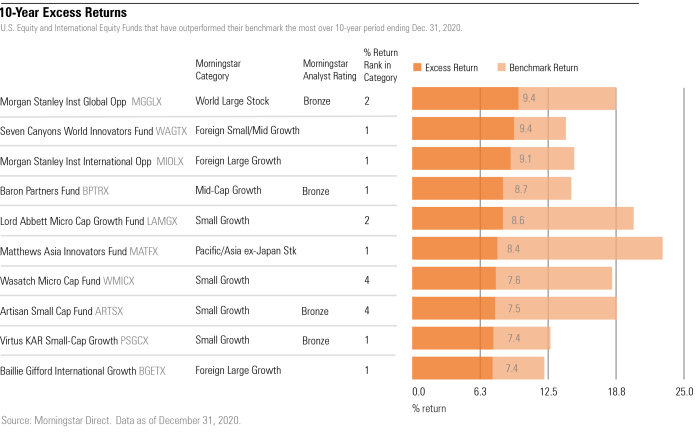

Considering different timeframes when analyzing historical performance is essential for a comprehensive understanding of a fund’s consistency and resilience. Short-term performance (e.g., 1-year or 3-year) can be heavily influenced by market fluctuations and might not reflect the long-term investment strategy. Longer-term performance (e.g., 5-year, 10-year, or even 20-year) offers a more stable and reliable picture of the fund’s ability to generate consistent returns over various market cycles.

This long-term perspective helps to filter out short-term noise and reveals the fund manager’s skill in navigating different market conditions. A fund with strong performance across multiple timeframes demonstrates greater consistency and potentially better risk management.

Comparative Performance of Top-Performing Equity Funds

The table below illustrates the performance of several hypothetical top-performing equity funds across various timeframes. Note that these are hypothetical examples and do not represent actual fund performance. Real-world data should be sourced from reputable financial databases.

| Fund Name | 5-Year Annualized Return | 10-Year Annualized Return | 20-Year Annualized Return (if available) |

|---|---|---|---|

| Fund A | 12.5% | 10.2% | 9.0% |

| Fund B | 11.8% | 11.5% | 8.5% |

| Fund C | 14.1% | 9.8% | N/A |

| Fund D | 9.7% | 10.0% | 10.5% |

Calculating Key Metrics

Annualized return is calculated using the following formula:

Annualized Return = [(Ending Value / Beginning Value)^(1 / Number of Years)] – 1

For example, if an investment grew from $10,000 to $16,105 over 5 years, the annualized return would be:

[(16105 / 10000)^(1/5)] – 1 ≈ 0.10 or 10%

The Sharpe ratio measures risk-adjusted return and is calculated as:

Sharpe Ratio = (Rp – Rf) / σp

Where:* Rp = Portfolio return

- Rf = Risk-free rate of return (e.g., the return on a government bond)

- σp = Standard deviation of portfolio return

Factors Influencing Equity Fund Performance

Equity fund performance is a complex interplay of various factors, none of which operate in isolation. Understanding these influences is crucial for investors seeking to make informed decisions and manage their expectations effectively. While past performance is not indicative of future results, analyzing these factors provides valuable insight into potential risks and opportunities.

Market Cycles and Equity Fund Returns

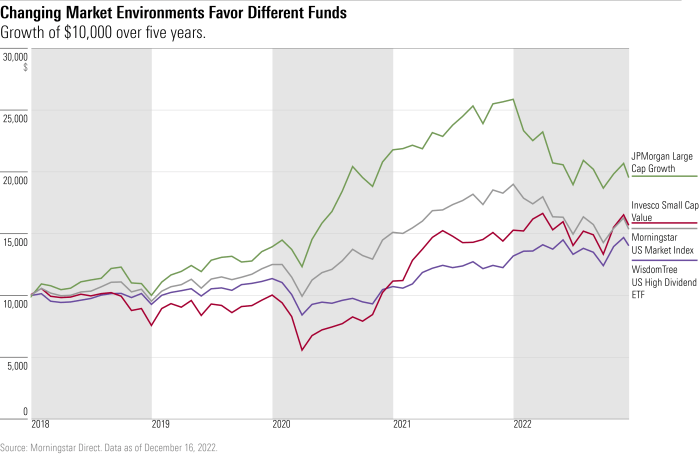

Market cycles, characterized by periods of bull (rising) and bear (falling) markets, significantly impact equity fund returns. During bull markets, characterized by rising stock prices and investor optimism, most equity funds tend to experience positive returns. The extent of these returns varies depending on the fund’s investment strategy and the specific sectors it focuses on. Conversely, bear markets, marked by falling prices and widespread pessimism, generally lead to negative returns for equity funds, although the magnitude of losses can differ substantially.

For example, a growth-focused fund might experience sharper declines during a bear market than a value-focused fund, as growth stocks are often more sensitive to economic downturns.

Equity Fund Style Performance in Different Market Conditions

Different equity fund styles exhibit varying performance characteristics across bull and bear markets. Growth funds, which invest in companies expected to experience rapid earnings growth, typically outperform during bull markets but underperform during bear markets. Value funds, which focus on undervalued companies, may offer more stability during bear markets, potentially outperforming growth funds during periods of economic uncertainty. For instance, during the 2008 financial crisis, value funds generally experienced less severe losses compared to growth funds.

Similarly, blend funds, which combine growth and value strategies, aim to balance risk and reward across different market conditions. Their performance often lies somewhere between that of pure growth and value funds.

Macroeconomic Factors and Equity Fund Performance

Macroeconomic factors, such as interest rates and inflation, exert a considerable influence on equity fund performance. Rising interest rates generally increase borrowing costs for companies, potentially impacting their profitability and slowing economic growth. This can negatively affect equity valuations. Conversely, lower interest rates can stimulate economic activity and boost corporate earnings, leading to higher equity prices. Inflation, on the other hand, erodes purchasing power and can impact corporate profits if companies struggle to pass on increased costs to consumers.

High inflation can also lead to central banks raising interest rates to combat it, further impacting equity markets. The 1970s stagflationary period, characterized by high inflation and slow economic growth, serves as a prime example of the negative impact of macroeconomic factors on equity returns.

Fund Manager Expertise and Performance

The skill and experience of the fund manager play a vital role in determining equity fund performance. A skilled manager can navigate market volatility, identify undervalued assets, and effectively manage risk, leading to superior returns. Their ability to make informed investment decisions, conduct thorough research, and adapt to changing market conditions is crucial. However, it’s important to remember that even the most experienced managers cannot consistently outperform the market.

Factors beyond their control, such as unforeseen global events, can significantly impact fund performance. The track record of a fund manager, their investment philosophy, and their team’s expertise are all important factors to consider when evaluating an equity fund.

Successfully navigating the world of equity funds necessitates a thorough understanding of historical performance, risk assessment, and the various factors that influence investment outcomes. While past performance is not indicative of future results, analyzing successful strategies and key performance indicators provides valuable insight. By considering the information presented here, investors can approach equity fund selection with a more informed and strategic perspective, ultimately working towards building a diversified and potentially high-yielding portfolio aligned with their individual financial goals.

Top FAQs

What is the difference between large-cap, mid-cap, and small-cap equity funds?

Large-cap funds invest in established companies with large market capitalizations; mid-cap funds focus on medium-sized companies; and small-cap funds invest in smaller, often younger companies. Each carries a different level of risk and potential return.

How frequently should I review my equity fund performance?

Regular review, at least annually, is recommended. More frequent monitoring may be appropriate depending on your investment goals and risk tolerance.

Are there any tax implications associated with equity fund investments?

Yes, capital gains taxes may apply when you sell your equity fund shares for a profit. Consult a financial advisor for specific tax advice.

What is an expense ratio, and why is it important?

The expense ratio represents the annual cost of managing the fund. Lower expense ratios generally lead to higher returns for investors.